Investing in Marijuana?

I’ve been asked several times over the past few months about investing in marijuana stocks. That’s a hard question to answer as there are so many different types of companies involved in the “Pot” business. In 2020, there was an estimated $50 billion dollars in sales coming from the legalized sale of marijuana here in the United States. This includes both the medical and recreational sales in states that have approved the sale of marijuana. Over the past several years, this growth has been moving along at a 40% increase each year according to the Marijuana Business Factbook.

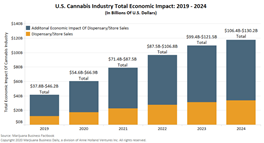

When you look at the potential of legalizing marijuana on a Federal level, in the United States alone (the US House of Representatives recently passed the MORE Act https://www.usatoday.com/story/news/politics/2020/12/04/legal-weed-house-vote-marijuana-legalization-bill/3791933001/), the Marijuana Business Daily says you’re looking at creating an economic impact of $130 billion by the year 2025.

Marijuana has now been legalized or decriminalized in 38 states by voters and state legislators. In Canada, weed has been legal across the country since October 17, 2018 giving the Canadians a head start in growing their marijuana economy. One of the benefits of having our neighbors to the North legalize marijuana is that the United States can watch and learn how to build and grow a weed economy.

How does a person invest in the infant US marijuana economy? As I mentioned earlier, there are many different ways to approach this. (As a disclaimer, any company name or other investments mentioned in this newsletter are not a recommendation to buy or sell as you should do your own research and make your own decisions).

- Individual marijuana company stocks. There are numerous companies out there that participate in a single, or multiple areas of the marijuana economy. These areas include growers, processors, product manufacturers, transportation, retail outlets, and fully integrated corporations. With states that have legally allowed medical and/or recreational marijuana over the past 5-10 years, this is where we are seeing some of the larger individual players take their experience in growing, processing, and creating end products, creating legal entities. Many of these companies are now to the point where they have issued stock as a way to raise funds for growth. This is where many outsiders are seeing these huge 500% or sometimes 1000%+ gains in the price of a stock and think “I have to get into marijuana stocks”. What people don’t realize is that most of these stocks are listed on the Over-the-Counter (OTC) exchange. This is the “Wild West”. According to Motley Fool contributor Eric Volkman, 80% of marijuana companies looking to be listed on the New York Stock Exchange (NYSE) or the NASDAQ exchange do not meet the financial requirements to be listed. As a result, these companies go to the OTC where there are no minimum financial requirements. If you go to a website like Yahoo Finance to look at the financials of these companies, their financials are so erratic, or sometimes, just completely not listed. Buyer beware! So, if you are looking to invest in some marijuana stocks, you can look at companies listed on the NYSE or the NASDAQ exchanges. The companies on these exchanges that are the largest and most established generally come from Canada as they have several years head start on the US.

- CBD versus THC companies. Within the marijuana industry, some companies only work within the CBD space which is federally legal throughout the United States. Most people are familiar with CBD products as a pain reliever you take orally or as a lotion. By avoiding the federally illegal THC, these companies do not have to work under the shadow of federal law and be constrained with how they process their revenue. It also allows them to take loans from banks and other lenders as banks are not allowed to give loans to companies operating in federally illegal areas like marijuana.

- Medical marijuana versus recreational weed companies. Medical marijuana in the United States is the largest opportunity for investors as it is approved in 33 states. Globally, it is expected to reach over $44 billion by 2025. Canada legalized medical marijuana back in 2001, so they have one of the most mature medical marijuana industries on the planet. There are numerous cannabis biotech and pharmaceutical companies researching and developing products based upon THC and other cannabinoids. Once marijuana is removed from the Schedule 1 drug list, big pharma and the biotech industry will be able to start clinical trials and explore more uses for medical marijuana.

- Supporting industries. Marijuana does not grow in a vacuum. To get down to the basics, all of the marijuana plants have to be grown somewhere. Whether it is grown in large greenhouses, or an individual is growing a couple of dozen plants in their backyard, the growing of the plants requires planting and irrigation equipment, fertilizers, and then harvesting and processing equipment. Believe it or not, many well-known corporations have exposure to the cannabis industry.

- Marijuana exchange-traded funds (ETF). Since there are so many marijuana companies to choose from, to go along with the many ancillary companies supporting the cannabis industry, it might be very difficult to figure out where to invest your funds. To make things easier, there are several dozen ETF’s that are a collection of marijuana stocks and supporting industry companies. Just do a google search for “marijuana EFT” and you will find several options.

Leave a Reply

Want to join the discussion?Feel free to contribute!