How the Money Supply Impacts the Broad Stock Markets

The impact of this stimulus money raises a handful of questions. When all of this money is being created and thrust into the US economy, what is really happening with the US “money supply”? Is the Federal Reserve (the “Fed”) creating money out of thin air, or does all of these trillions of dollars really exist someplace? Will having over $5 trillion dollars dumped into the economy have a positive or negative impact on investments, inflation and real estate? Let’s take a look at the potential impact the COVID relief packages could have in the near future. But before we do, let’s look at the definition of “money supply” and how the Fed controls it.

The amount of money in an economy is referred to as the money supply. This consists of far more than the bills and coins in circulation. Currency usually accounts for around 10% of the existing money supply at any point in time. The remaining money supply consists of bank deposits and other liquid investments.

The Federal Reserve conducts open market operations, the buying or selling of short-term notes, and long-term bonds to control the money supply. With these transactions, the Fed can expand or contract the amount of money in the banking system and drive short-term interest rates lower or higher, depending on the objectives of its monetary policy.

During a recession or economic downturn, like the year 2020, the Fed will seek to expand the supply of money in the economy with a goal of lowering the interest rate at which banks lend to each other. This in turn lowers all lending interest rates utilized for commercial/personal loans, homes, cars, household goods, etc.

To do this, the Fed purchases bonds from other banks and other financial institutions, and in 2020 some corporate debt, and deposits payments (money) into the accounts of the sellers. This increases the amount of money that banks and financial institutions have on hand, and banks can use these funds to provide loans. With more money on hand, banks will lower interest rates to entice consumers and businesses to borrow and invest, thereby stimulating the economy and employment.

The Fed performs the opposite process when the economy is overheating and inflation has increased to an uncomfortable level. When the Fed sells bonds to the banks, it takes money out of the financial system, thereby reducing the money supply. This causes interest rates to rise, discouraging people and businesses from borrowing and investing. This has the effect of slowing inflation and economic growth. (source: https://www.investopedia.com/ask/answers/06/openmarketoperations.asp)

When it comes to the $5 trillion COVID relief money, this was money provided by the Federal Reserve who would basically buy an unlimited amount of US Treasury bonds and government-backed mortgage bonds to provide the funds for the CARES Act and other relief efforts. We know from the above paragraphs, that by placing more money into the money supply and the economy, interest rates will remain at historical lows in an effort to stimulate the depressed economy due to all the COVID regulations and restrictions/closures.

What about the impact of all this money supply on investments and the stock market? Many financial experts state that an increase in the money supply only benefits those who invest in the stock market. One reason is that an increase in money supply and the resulting drop in interest rates makes the stock market a more attractive investment. When investors are faced with low earnings potential on bank CD’s or US Treasuries, as is occurring today, and with many investments returning less than 1%, money is invested in the stock market where the potential for higher returns is greater than conventional “safe” investments.

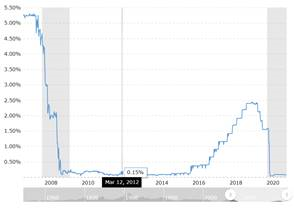

Here is a historical look of where interest rates have been since the 2008 real estate bubble popped. You can see how quickly the Fed dropped interest rates from 5 ¼% to virtually zero. And what is the playbook for COVID-19? The same thing. Drop interest rates to near zero. As described above, when interest rates are running at historical lows, it’s the stock market that becomes more attractive to investors. With the Fed already announcing that it is highly unlikely to raise interest rates in the year 2021, the stock market looks like it may be one of the better-performing investments for the year.

Another reason for optimism that the stock market might outperform other investments in 2021 has to do with the general increase in demand of goods and services in response to the increased money supply. Stock prices tend to move higher when the money supply in an economy is high. When plenty of money is in circulation, more money is available to invest in stocks while other investments, such as bonds, become less attractive. When interest rates are low, mortgage rates also decline, making homes more affordable and increasing demand for such items as TV sets, washing machines and so on. Car sales also go up when financing rates go down. All of this helps make the bottom line for corporations look better; therefore, increasing the value of their stocks.

(source:https://finance.zacks.com/relationship-between-money-supply-stock-prices-7764.html)

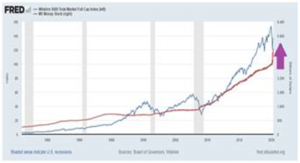

This chart shows the Fed response with the money supply after the 2008-2009 stock market crash.

Starting in 2009, the money supply has been increased consistently each year and then, you can see the huge spike up when Congress approved the $3 trillion COVID-19 relief package. This demonstrates that when the money supply is increased, the stock market usually responds in a favorable direction.

With the recently proposed $1.9 trillion stimulus package being approved by Congress, I would anticipate that the stock markets will continue to move forward through the rest of the year. However, only time will tell.

Leave a Reply

Want to join the discussion?Feel free to contribute!